The Malaysia Budget 2025, presented as the Third MADANI Budget by our Prime Minister YAB Dato’ Seri Anwar Bin, marks a historic allocation of RM421 billion and outlines a comprehensive agenda for the nation’s economic growth and reform. The goal of this budget is to tackle major issues including infrastructure development, public welfare, and much more.

We will give an overview of Malaysia’s Budget 2025 in this blog post and point out the main ideas that would impact individuals either directly or indirectly.

Key Highlights of Malaysia Budget 2025

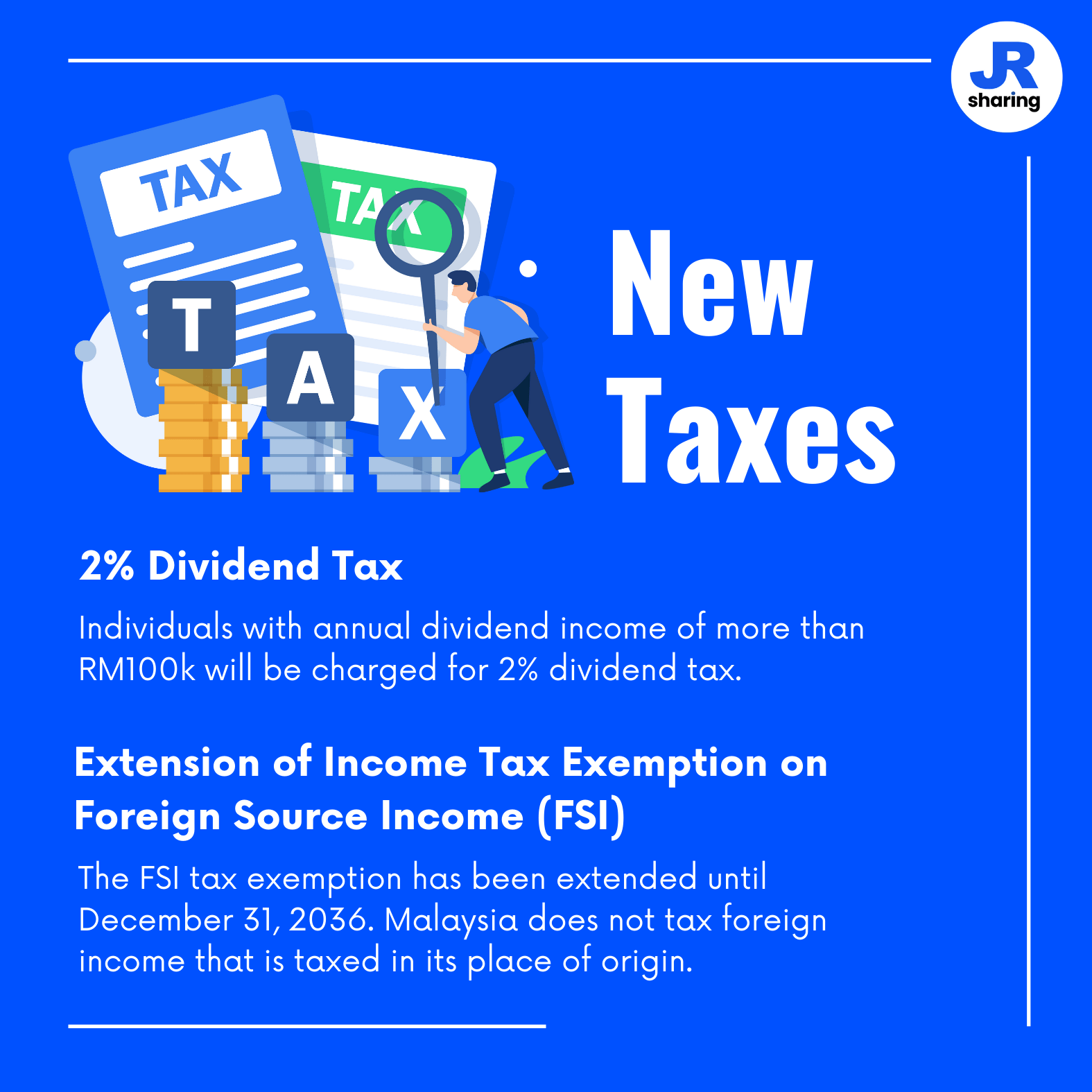

New Taxes

2% Dividend Tax

Individuals with annual dividend income of more than RM100k will be charged for 2% dividend tax.

Extension of Income Tax Exemption on Foreign Source Income (FSI)

FSI income tax exemption extension till December 31, 2036 (which was set to expire on December 31, 2026). Foreign income that has already been taxed in the country of origin is free from taxation in Malaysia.

Self-Assessment System for Stamp Duty

A stamp duty self-assessment system will be set up in phases from January 2026 to January 2028. Depending on the type of agreement or document, individuals are expected to determine the stamp duty amount on their own.

Tax Incentive Package for Forest City Special Financial Zone (FCSFZ)

To encourage tourists and strengthen the local economy, the Forest City Special Financial Zone (FCSFZ) located at Iskander Puteri, Johor, has been declared a duty-free island.

Indirect Taxes

Increased on excise duty on sugar-sweetened beverages

Starting from 1 January 2025, the excise duty on sugar-sweetened beverages will increase by RM0.40 per litre, phased in over time.

Explore beverage vouchers on Shopee and Lazada.

Review of Export Duty Exemption on Crude Palm Oil (CPO)

Crude palm oil (CPO) export duties will be changed as of November 1, 2024. There will be revised price ranges for CPO above RM3,450 per metric tonne, with export duty rates varying between 8.0% and 10.0%.

Sales Tax Exemption on Mastectomy Bras for Breast Cancer Patients

Breast cancer patients’ mastectomy bras will be free from sales tax starting from November 1, 2024, to December 31, 2027. This exemption applies to applications submitted to the Ministry of Finance (MOF).

Review of the Rate of Sales Tax

Starting 1 May 2025, the sales tax rate will increase on non-essential items, specifically on imported premium goods.

Expansion of Scope of Taxable Services

Starting from 1 May 2025, there will be a new service tax applied to commercial service transactions between businesses, such as consulting, marketing, and more.

Explore Zumax Digital Marketing Services.

Individual Income Tax Reliefs

Tax Relief for Sports Activities, Health, and Elderly Care

- Sports Activities: The RM1,000 relief for sports equipment and activities will now cover expenses for parents.

Explore Sport Equipment on Shopee.

- Medical Check-ups: Vaccinations will now be covered by the RM1,000 relief for parents’ medical examinations.

- Parental and Elder Care: Grandparents are now eligible for elder care assistance, which includes medical, non-cosmetic dental care, daycare, and immunisations (up to RM1,000).

- Child and Elderly Care Allowance: The RM3,000 annual tax exemption on child care allowance paid by employers will be expanded to cover elderly care (for parents or grandparents).

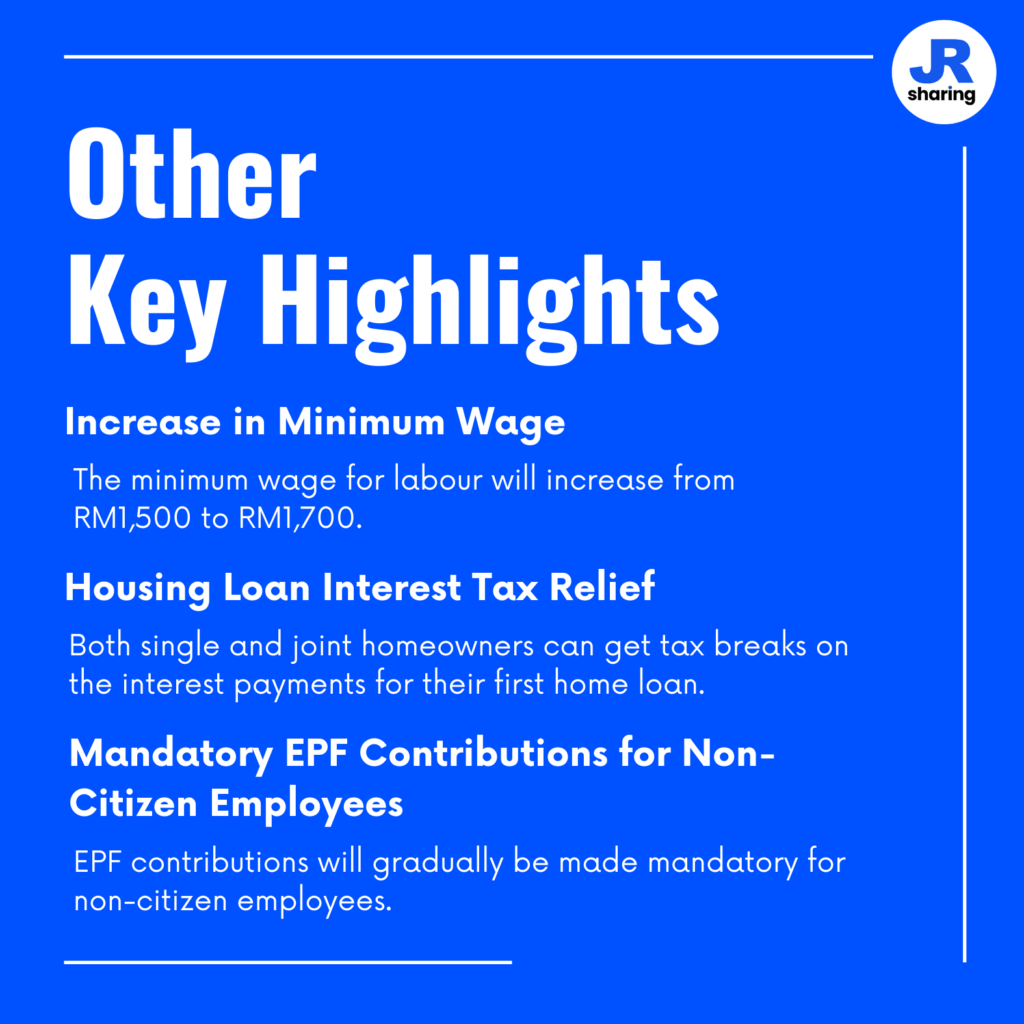

Housing Loan Interest Tax Relief

Both individual and joint owners are eligible for tax breaks on their first residential home loan interest payments.

Relief for Domestic Food Waste Composting Machines

Homeowners can now get income tax relief from purchasing food waste composting equipment. Tax savings of up to RM2500 are available once (YA 2025 to YA 2027).

Shop Food Waste Composting Machines.

Other Key Initiatives of 2025 Budget

e-Rebate on Energy-Efficient Equipment

A RM70 million e-Rebate initiative encourages consumers and business owners to purchase energy-efficient electrical equipment.

Explore Philips energy-saving products now.

Rebate for Electric Motorcycles

A rebate of up to RM2,400 is available for individuals who purchase CKD EV motorcycles; this is funded by our government with a budget of RM10 million.

Explore electric motorcycles.

Increase in Minimum Wage

Effectively from February 1, 2025, the minimum wage for labour will increase from RM1,500 to RM1,700. Companies with fewer than five employees have six months to comply until August 1, 2025.

Mandatory EPF Contributions for Non-Citizen Employees

EPF contributions will gradually be made mandatory for non-citizen employees to ensure equitable workplace treatment.

Conclusion

Malaysia’s Budget 2025 shows a strong commitment to tackling economic, social, and environmental issues while laying the groundwork for sustainable growth. This budget aims to promote equity, empower businesses, and uplift public welfare through tax cuts, targeted reliefs, and meaningful initiatives. Acts like increasing the minimum wage, providing tax relief for purchasing eco-friendly products, or providing tax relief for house loans will affect individuals or businesses directly and indirectly.

Navigating the shifting economic landscape in the future involves an awareness of these changes and the ability to take advantage of the opportunities they offer. Be proactive and knowledgeable to take full advantage of Budget 2025’s benefits. For the Malay version, refer to Malaysia Bajet 2025.

Follow us for more news & deals: JR Sharing | Telegram | Facebook | Instagram